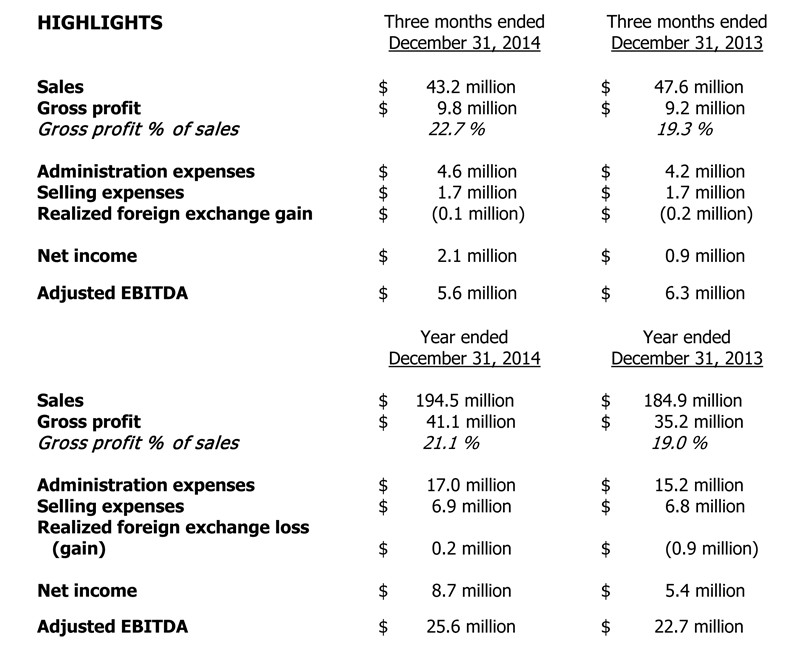

WINNIPEG, Manitoba, March 10, 2015 /CNW/ — Pollard Banknote Limited (TSX: PBL) (“Pollard”) today released its financial results for the three months and year ended December 31, 2014, with improved fourth quarter gross profit and net income compared to 2013.

“We are very pleased with our financial results for the 2014 fiscal year and the fourth quarter,” commented Co-Chief Executive Officer John Pollard. “The positive trends experienced during the year have continued and we expect the same to carry on through 2015.”

“We achieved record revenue in 2014, driven by the success of our proprietary products including our Scratch FX® and PlayBook® instant tickets. Our strong portfolio of contracts, including a number of new contracts obtained in 2014, allowed us to maintain significant momentum throughout the year. Sales of our licensed games product line were also strong throughout the year. Our production volumes reached record levels during the year and our average selling prices were ahead of 2013. Were it not for the timing of a large amount of goods in transit over year end our annual ticket sales volumes would also have reached record levels.”

“Our free cash flow was very strong during the year, allowing us to continue to pay down our bank debt in addition to funding a large amount of our almost $19 million in total capital expenditures.”

“The weakening Canadian dollar, particularly in reference to the U.S. dollar, brings multiple benefits to Pollard. Not only does the amount of net cash inflow increase due to greater equivalent Canadian dollar receipts, it also makes us more competitive in bidding for future work. Continued weakening of the dollar in the first quarter of 2015 is a positive trend for our company”

“Our fourth quarter results generated higher net income and gross profit margins versus 2013 reflecting a strong production mix of high valued products. Our top line revenue and adjusted EBITDA were slightly lower due solely to a large amount of in transit product at year end, however this revenue will be reflected in our first quarter 2015 results.”

“The official start-up of our Michigan Lottery ilottery internet site occurred in the fourth quarter and the initial results have been very encouraging. All metrics have met or exceeded original targets including revenue, player registrations and net proceeds for the lottery. While still a modest part of our overall results in absolute numbers, the financial upside is potentially significant and we look forward to replicating our success in the future as more lotteries embrace the internet as a viable distribution method.”

“Our two major development projects progressed well over the fourth quarter of 2014 and the early part of 2015. Our major press expansion remains on target for second quarter commissioning and will fundamentally change the capacity and capabilities of Pollard. At the same time, the implementation of our ERP system includes a staged roll-out beginning in the second quarter of 2015 and will provide us the infrastructure to maximize the utilization of all our processes including our new press line.”

“The lottery industry had another good year in 2014 and all signs point to continuing growth. Lotteries are increasingly relying on instant tickets as their main generator of funds, particularly given declining sales in the lotto or draw based games over the last 12 months. The increasing market size of the instant ticket product line provides us with significant opportunities for greater sales and revenue.”

“We are very proud of the results we achieved in 2014 and are excited about 2015. Our industry is growing and expanding into new areas and Pollard is poised to benefit. Not only have we achieved very good financial results in 2014, but we have also laid a strong foundation to expand our organization and capitalize on these growth opportunities.”

Use of Non-GAAP Financial Measures

Reference to “Adjusted EBITDA” is to earnings before interest, income taxes, depreciation and amortization, unrealized foreign exchange gains and losses, mark-to-market gains and losses on foreign currency contracts, and certain non-recurring items including start-up costs, settlement loss on pension curtailment and restructuring costs. Adjusted EBITDA is an important metric used by many investors to compare issuers on the basis of the ability to generate cash from operations and management believes that, in addition to net income, Adjusted EBITDA is a useful supplementary measure.

Adjusted EBITDA is a measure not recognized under GAAP and does not have a standardized meaning prescribed by GAAP. Therefore, this measure may not be comparable to similar measures presented by other entities. Investors are cautioned that Adjusted EBITDA should not be construed as an alternative to net income determined in accordance with GAAP as an indicator of Pollard’s performance or to cash flows from operating, investing and financing activities as measures of liquidity and cash flows.

POLLARD BANKNOTE LIMITED

Pollard is one of the leading providers of products and services to lottery and charitable gaming industries throughout the world. Management believes Pollard is the largest provider of instant tickets based in Canada and the second largest producer of instant tickets in the world.

The selected financial and operating information has been derived from, and should be read in conjunction with, the consolidated financial statements of Pollard, as at and for the year ended December 31, 2014. These financial statements have been prepared in accordance with the International Financial Accounting Standards (“IFRS” or “GAAP”).

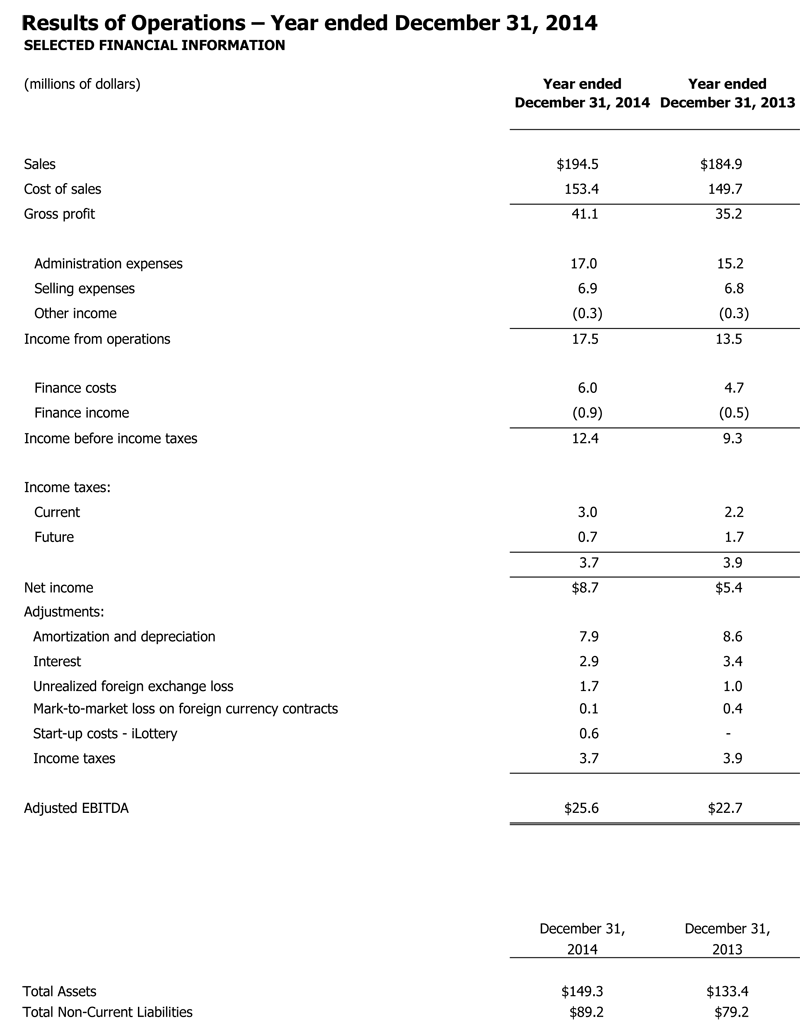

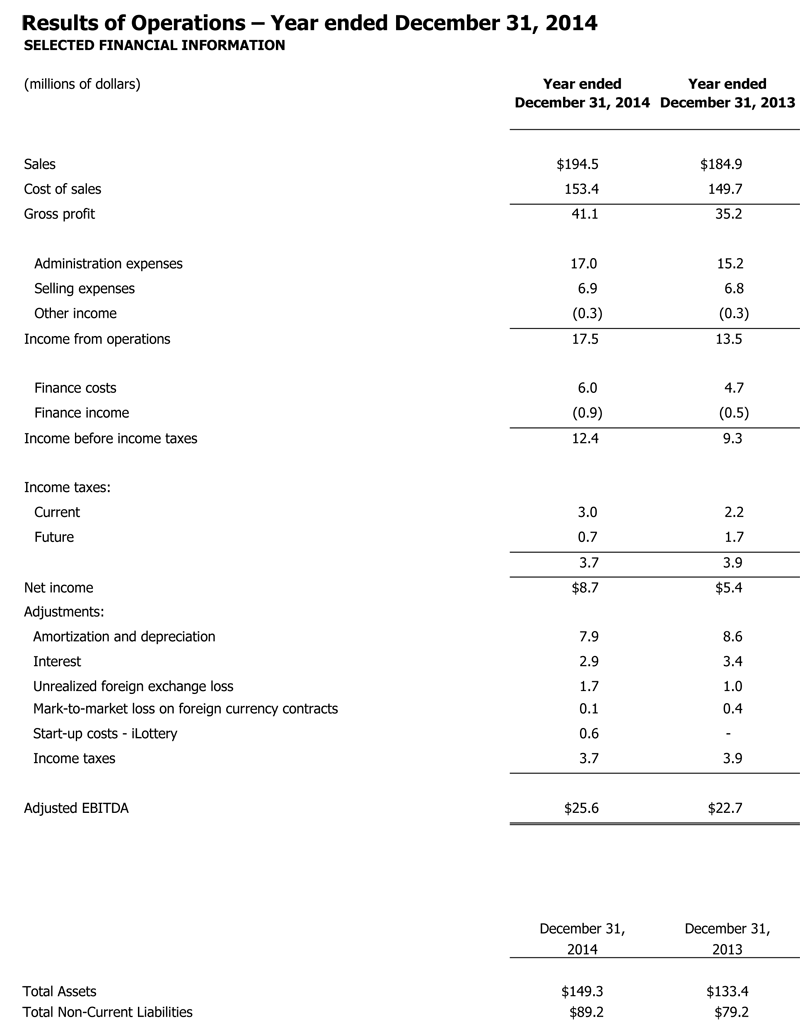

Results of Operations – Year ended December 31, 2014

Sales

During the year ended December 31, 2014 (“Fiscal 2014” or “2014”), Pollard achieved sales of $194.5 million, compared to $184.9 million in the year ended December 31, 2013 (“Fiscal 2013” or “2013”). Factors impacting the $9.6 million sales increase were:

Higher instant ticket average selling prices for Fiscal 2014 increased sales by $5.4 million compared to Fiscal 2013. This increase was partially a result of increased sales of proprietary products including Scratch FX® and PlayBook® games in 2014. Lower instant ticket sales volumes decreased sales by $5.4 million compared to Fiscal 2013. The majority of this decrease was a result of a significant amount of goods in transit at year-end to international customers. Higher sales of our ancillary instant ticket products and services increased sales by $0.9 million from Fiscal 2013. Charitable gaming volumes were higher than Fiscal 2013 increasing sales by $0.8 million, which was offset by the decrease in average selling price which reduced sales by $0.9 million. A decrease in machine volumes in Fiscal 2014 decreased sales by $0.1 million when compared to 2013.

During Fiscal 2014, Pollard generated approximately 62.3% (2013 – 64.9%) of its revenue in U.S. dollars including a portion of international sales which are priced in U.S. dollars. During Fiscal 2014 the actual U.S. dollar value was converted to Canadian dollars at $1.097 compared to a rate of $1.028 during Fiscal 2013. This 6.7% increase in the U.S. dollar value resulted in an approximate increase of $7.6 million in revenue relative to Fiscal 2013. Also during Fiscal 2014, the Canadian dollar weakened against the Euro resulting in an approximate increase of $1.4 million in revenue relative to Fiscal 2013.

Cost of sales and gross profit

Cost of sales was $153.4 million in Fiscal 2014 compared to $149.7 million in Fiscal 2013. Cost of sales was higher in Fiscal 2014 relative to Fiscal 2013 as a result of higher exchange rates on U.S. dollar transactions in 2014 which increased cost of sales approximately $6.3 million. Also included in cost of sales in Fiscal 2014 was $0.6 million of non-recurring start-up costs related to Pollard’s new iLottery operations. Partially offsetting these increases were reduced costs due to lower volumes, the production mix and recognition of scientific research and experimental development (“SRED”) tax credits.

Gross profit was $41.1 million (21.1% of sales) in Fiscal 2014 compared to $35.2 million (19.0% of sales) in Fiscal 2013. This increase was due mainly to increased average selling price of instant tickets, the higher value of U.S. dollars converted into Canadian dollars and increased sales of ancillary instant ticket products and services. Gross profit excluding non-recurring iLottery start-up costs was $41.7 million (21.4% of sales).

Administration expenses

Administration expenses increased to $17.0 million in Fiscal 2014 from $15.2 million in Fiscal 2013 as a result of increased compensation expenses relating to additional manufacturing support activities including technology, information systems and research and development. The increase in expense was also due to a lower amount of capitalized labour in Fiscal 2014 relating to internal projects.

Selling expenses

Selling expenses were $6.9 million in Fiscal 2014 which was similar to $6.8 million in Fiscal 2013.

Interest expense

Interest expense decreased to $2.9 million in Fiscal 2014 from $3.4 million in Fiscal 2013 primarily as a result of lower interest rates.

Foreign exchange loss

The net foreign exchange loss was $1.9 million in Fiscal 2014 compared to a net loss of $0.1 million in Fiscal 2013. The 2014 net foreign exchange loss consisted of a $1.7 million unrealized loss which was primarily as a result of the increased Canadian equivalent value of U.S. denominated debt and accounts payable due to the weakening of the Canadian dollar relative to the U.S. dollar. The realized foreign exchange loss of $0.2 million was predominately a result of decreased value of foreign currency converted into Canadian dollars during Fiscal 2014.

Within the 2013 net foreign exchange loss were realized foreign exchange gains of $0.9 million comprised of $1.0 million realized gain on the increased value of U.S. dollar denominated receivables and the conversion of U.S. dollars and Euros into Canadian dollars, partially offset by $0.1 million of realized loss relating to payments made on U.S. dollar denominated payables. Offsetting the realized foreign exchange gains were unrealized foreign exchange losses of $1.0 million comprised of an unrealized foreign exchange loss of $0.9 million on U.S. dollar denominated debt and $0.1 million unrealized foreign exchange loss on net U.S. denominated receivables and payables.

Amortization and depreciation

Amortization and depreciation, including depreciation of property and equipment and the amortization of deferred financing costs and intangible assets, totaled $7.9 million during Fiscal 2014 which decreased from $8.6 million during Fiscal 2013 due to decreased amortization of deferred financing costs and license fees.

Adjusted EBITDA

Adjusted EBITDA was $25.6 million in Fiscal 2014 compared to $22.7 million in Fiscal 2013. The primary reasons for the increase in Adjusted EBITDA was the increase in gross profit of $5.9 million. Partially offsetting this increase were the increase in administration expenses of $1.8 million and higher realized foreign exchange losses of $1.1 million.

Income taxes

Income tax expense was $3.7 million in Fiscal 2014, an effective rate of 30.0%, due primarily to differences relating to the foreign exchange impact of Canadian dollar denominated debt in its U.S. subsidiaries. Pollard has capitalized its U.S. operations using intercompany Canadian dollar debt. The weakening of the Canadian dollar versus the U.S. dollar results in a future gain on debt repayment for U.S. tax purposes in the subsidiary, creating a deferred tax expense with no related income (as the gain is eliminated on consolidation). This increased the consolidated provision percentage by about 6%.

Income tax expense was $3.9 million in Fiscal 2013, an effective rate of 41.8%, due primarily to differences relating to the foreign exchange impact of Canadian dollar denominated debt in its U.S. subsidiaries. Pollard has capitalized its U.S. operations using intercompany Canadian dollar debt. The weakening of the Canadian dollar versus the U.S. dollar results in a future gain on debt repayment for U.S. tax purposes in the subsidiary, creating a deferred tax expense with no related income (as the gain is eliminated on consolidation). This increased the consolidated provision percentage by about 9%. Other permanent differences relating to the foreign exchange translation of property, plant and equipment increased the provision by approximately 3%.

Net income

Net income was $8.7 million in Fiscal 2014 compared to net income of $5.4 million in Fiscal 2013. The primary reasons for the increase were the increase in gross profit of $5.9 million, a reduction in interest expense of $0.5 million, a reduction of $0.3 million in the non-cash mark-to-market loss on foreign currency contracts and a decrease in income taxes of $0.2 million. Partially offsetting these increases to net income were the increase in administration expenses of $1.8 million and an increase in foreign exchange loss of $1.8 million.

Earnings per share (basic and diluted) increased to $0.37 per share in Fiscal 2014 from $0.23 per share in Fiscal 2013.

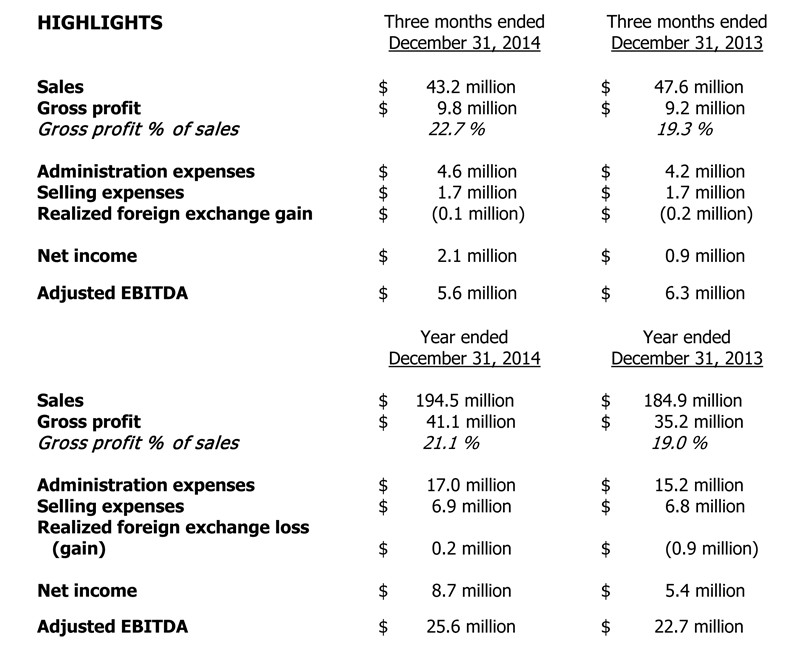

Results of Operations – Three months ended December 31, 2014

During the three months ended December 31, 2014, Pollard achieved sales of $43.2 million, compared to $47.6 million in the three months ended December 31, 2013. Factors impacting the $4.4 million sales decrease were:

Instant ticket sales volumes for the fourth quarter of 2014 were lower than the fourth quarter of 2013 by 13.2%, which combined with a decrease in our ancillary instant ticket products and services volumes, primarily licensed games, reduced sales by $5.8 million. The majority of this decrease was a result of a significant amount of goods in transit at year-end to international customers. In addition, a decrease in average selling price of instant tickets compared to 2013 further decreased sales by $0.5 million. Lower charitable gaming volumes for the quarter decreased sales compared to 2013 by $0.3 million, while an increase in the average selling price increased sales by $0.2 million when compared to the fourth quarter of 2013.

During the three months ended December 31, 2014, Pollard generated approximately 60.8% (2013 – 59.8%) of its revenue in U.S. dollars including a portion of international sales which were priced in U.S. dollars. During the fourth quarter of 2014 the actual U.S. dollar value was converted to Canadian dollars at $1.137, compared to the rate of $1.047 during the fourth quarter of 2013. This 8.6% increase in the value of the U.S. dollar resulted in an approximate increase of $2.0 million in revenue relative to 2013.

Cost of sales was $33.4 million in the fourth quarter of 2014 compared to $38.4 million in the fourth quarter of 2013. Cost of sales was lower in the quarter relative to the fourth quarter of 2013 primarily as a result of decreased sales volumes and the recognition of SRED tax credits. Partially offsetting the decrease, higher exchange rates on U.S. dollar transactions in the fourth quarter of 2014 increased cost of sales approximately $1.6 million when compared to the fourth quarter of 2013.

Gross profit was $9.8 million (22.7% of sales) in the fourth quarter of 2014 compared to $9.2 million (19.3% of sales) in the fourth quarter of 2013. This increase in gross profit dollars was due mainly to the higher value of U.S. dollars converted into Canadian dollars and the recognition of SRED tax credits, partially offset by the gross profit reduction on lower sales volumes.

Administration expenses were $4.6 million in the fourth quarter of 2014 which was higher compared to $4.2 million in the fourth quarter of 2013 due in part to higher costs related to business development initiatives.

Selling expense was $1.7 million in the fourth quarter of 2014 which was similar to $1.7 million in the fourth quarter of 2013.

Interest expense decreased to $0.6 million in the fourth quarter of 2014 from $0.8 million in the fourth quarter of 2013 primarily as a result of lower interest rates.

The net foreign exchange loss was $0.8 million in the fourth quarter of 2014 compared to a net loss of $0.3 million in the fourth quarter of 2013. The 2014 net foreign exchange loss consisted of an unrealized foreign exchange loss of $0.9 million which was mostly as a result of the increased Canadian equivalent value of U.S. denominated payables and long-term debt caused by the weakening of the Canadian dollar relative to the U.S. dollar at the end of the quarter. The additional realized foreign exchange gain of $0.1 million, was predominately a result of the increased value of U.S. denominated receivables, offset partially by increased cost of U.S. denominated payables.

Within the 2013 fourth quarter net foreign exchange loss was an unrealized foreign exchange loss of $0.5 million consisting of $0.4 million relating to unrealized foreign exchange loss on U.S. dollar denominated debt and $0.1 million relating to the unrealized foreign exchange loss on net U.S. dollar denominated receivables and payables. Partially offsetting the unrealized foreign exchange loss was a $0.2 million realized foreign exchange gain on the increased value of U.S. and Euro denominated receivables.

Amortization and depreciation, including depreciation of property, plant and equipment and the amortization of deferred financing costs and intangible assets, totaled $2.0 million during the fourth quarter of 2014 which decreased from $2.7 million during the fourth quarter of 2013 as a result of decreased amortization of development costs and license fees in 2014.

Adjusted EBITDA was $5.6 million in the fourth quarter of 2014 compared to $6.3 million in the fourth quarter of 2013. The primary reasons for the decrease in Adjusted EBITDA were the decrease in gross profit (net of amortization and depreciation) of $0.1 million and higher administration expenses of $0.4 million.

Income tax expense was nil in the fourth quarter of 2014, an effective rate of 0.0%. Included in the effective rate are differences relating to the foreign exchange impact of Canadian dollar denominated debt in its U.S. subsidiaries. Pollard has capitalized its U.S. operations using intercompany Canadian dollar debt. The significant weakening of the Canadian dollar versus the U.S. dollar in the fourth quarter results in a future gain on debt repayment for U.S. tax purposes in the subsidiary, creating a deferred tax expense with no related income (as the gain is eliminated on consolidation). This increased the consolidated provision percentage by about 16%. Other permanent differences relating to the foreign exchange translation of property, plant and equipment decreased the provision by approximately 15%. In addition, adjustments in the annual estimated tax rate to the actual tax rate in the U.S. subsidiaries decreased the provision by approximately 28%.

Income tax expense was $1.0 million in the fourth quarter of 2013, an effective rate of 52.6%, due primarily to differences relating to the foreign exchange impact of Canadian dollar denominated debt in its U.S. subsidiaries. Pollard has capitalized its U.S. operations using intercompany Canadian dollar debt. The significant weakening of the Canadian dollar versus the U.S. dollar in the fourth quarter results in a future gain on debt repayment for U.S. tax purposes in the subsidiary, creating a deferred tax expense with no related income (as the gain is eliminated on consolidation). This increased the consolidated provision percentage by about 16%. Other increases were due to permanent differences relating to the translation of the company’s U.S. subsidiaries.

Net income was $2.1 million in the fourth quarter of 2014 compared to $0.9 million in the fourth quarter of 2013. The primary reasons for the increase were the increase in gross profit of $0.6 million, the $1.0 million decrease in the non-cash mark-to-market loss on foreign currency contracts, a decrease in income tax expense of $0.4 million and the $0.2 million decrease in interest expense. Partially offsetting these increases in net income were the increase in administration expenses of $0.4 million and the $0.5 million increase in net foreign exchange loss.

Earnings per share (basic and diluted) increased to $0.09 per share in the fourth quarter of 2014 from $0.04 per share in the fourth quarter of 2013.

Outlook

The outlook for both our industry and Pollard for 2015 is very positive. The lottery industry continues to generate robust growth, particularly in the instant ticket product line. Consumer demand for instant tickets remains strong and this trend is anticipated to continue. Government jurisdictions continue to look for ways to generate increased funds for their good causes and instant tickets continue to be a key mechanism to accomplish this goal. Recent industry data has shown retail sales growth of instant tickets in the 6-8% range in 2014.

Our current contract portfolio is strong and will support our anticipated level of business as we benefit from a full year of volumes from our new contracts won during 2014. We have no major contracts coming due in 2015 when extensions are considered and we will strategically tender for other lottery contracts that come up for bid.

We anticipate our production volumes remaining at similar levels to that of 2014 in the first half of the year prior to our new press coming on stream. We will work diligently to build our volume once the press line is fully operational. Contracts usually run on a 3-5 year cycle so the buildup of additional volumes will follow a disciplined and strategic approach.

Our average selling prices have trended positively over the last two years and we expect this to continue. Strong sales of our value added proprietary products are forecasted to continue as lotteries have recognized the additional return on investment to be earned when utilizing our key products such as Scratch FX® or our unique PlayBook® offerings. The success of these products underlines the importance of innovation in our industry and we will focus on ongoing research and development initiatives including using a structured development process to maximize our innovation success. Products such as our exclusive PlayAround™ Fold-Over ticket and our environmentally friendly Eco ScratchTM instant ticket are just two examples of recent products currently gaining traction in the marketplace.

The Michigan Lottery iLottery site will continue to evolve from start-up to a more mature operation and we are hopeful the initial success experienced in 2014 will continue going forward. We expect the iLottery market in the United States will grow as more lotteries make the decision to develop this distribution method and we will look to replicate our success in Michigan to other jurisdictions.

Licensed games sales vary based on the timing and availability of certain licensed properties and 2015 revenue for this product line is anticipated to be slightly lower than the last two years of record levels. We are actively sourcing new licensed properties that will resonate in the lottery space and will be vigorously promoting our current best sellers such as Frogger and Tetris®.

As our lottery customers expand the breadth and sophistication of their product offerings, we have renewed our focus on utilizing strategic alliances with outside organizations to expand and grow our own expertise, including more actively pursuing acquisition opportunities to bring additional value added capability to Pollard.

The weakening of the Canadian dollar has provided additional positive impacts on our net operating cash flow during 2014 and this ongoing trend will have a positive effect on future net cash flows. A weaker Canadian dollar also allows us to be more competitive in bidding for new work which will be important as our new capacity comes on stream later in 2015.

Our new press expansion project continues to track on time with a commissioning planned for the second quarter of 2015. The new press line will add significant new capacity to our production capability and additionally will provide improved efficiencies and lower per unit costs on our existing volumes.

We will continue on our ERP system development during the next year and anticipate the initial roll out to begin during the second quarter of 2015, with a number of modules being implemented over the last half of 2015. Implementation of our ERP system and related management processes will provide a foundation to maximize returns on both our existing operations and the new press expansion.

Budgeted capital expenditures for 2015 are expected to be lower than the levels of expenditures incurred in 2014, although still higher than historical levels due to the completion of the press expansion and ERP projects.

We anticipate our internal operating cash flow over the next year generating sufficient funds to satisfy all of our requirements including the capital expenditures required to complete our new press line expansion and the implementation of our ERP system initiative. Our current credit facility provides flexibility and capacity to support our various strategic initiatives and any additional excess cash inflow will be used to reduce our senior bank debt.

“We are very pleased with our financial results for the 2014 fiscal year and the fourth quarter,” commented Co-Chief Executive Officer John Pollard. “The positive trends experienced during the year have continued and we expect the same to carry on through 2015.”

“We achieved record revenue in 2014, driven by the success of our proprietary products including our Scratch FX® and PlayBook® instant tickets. Our strong portfolio of contracts, including a number of new contracts obtained in 2014, allowed us to maintain significant momentum throughout the year. Sales of our licensed games product line were also strong throughout the year. Our production volumes reached record levels during the year and our average selling prices were ahead of 2013. Were it not for the timing of a large amount of goods in transit over year end our annual ticket sales volumes would also have reached record levels.”

“Our free cash flow was very strong during the year, allowing us to continue to pay down our bank debt in addition to funding a large amount of our almost $19 million in total capital expenditures.”

“The weakening Canadian dollar, particularly in reference to the U.S. dollar, brings multiple benefits to Pollard. Not only does the amount of net cash inflow increase due to greater equivalent Canadian dollar receipts, it also makes us more competitive in bidding for future work. Continued weakening of the dollar in the first quarter of 2015 is a positive trend for our company”

“Our fourth quarter results generated higher net income and gross profit margins versus 2013 reflecting a strong production mix of high valued products. Our top line revenue and adjusted EBITDA were slightly lower due solely to a large amount of in transit product at year end, however this revenue will be reflected in our first quarter 2015 results.”

“The official start-up of our Michigan Lottery ilottery internet site occurred in the fourth quarter and the initial results have been very encouraging. All metrics have met or exceeded original targets including revenue, player registrations and net proceeds for the lottery. While still a modest part of our overall results in absolute numbers, the financial upside is potentially significant and we look forward to replicating our success in the future as more lotteries embrace the internet as a viable distribution method.”

“Our two major development projects progressed well over the fourth quarter of 2014 and the early part of 2015. Our major press expansion remains on target for second quarter commissioning and will fundamentally change the capacity and capabilities of Pollard. At the same time, the implementation of our ERP system includes a staged roll-out beginning in the second quarter of 2015 and will provide us the infrastructure to maximize the utilization of all our processes including our new press line.”

“The lottery industry had another good year in 2014 and all signs point to continuing growth. Lotteries are increasingly relying on instant tickets as their main generator of funds, particularly given declining sales in the lotto or draw based games over the last 12 months. The increasing market size of the instant ticket product line provides us with significant opportunities for greater sales and revenue.”

“We are very proud of the results we achieved in 2014 and are excited about 2015. Our industry is growing and expanding into new areas and Pollard is poised to benefit. Not only have we achieved very good financial results in 2014, but we have also laid a strong foundation to expand our organization and capitalize on these growth opportunities.”

Use of Non-GAAP Financial Measures

Reference to “Adjusted EBITDA” is to earnings before interest, income taxes, depreciation and amortization, unrealized foreign exchange gains and losses, mark-to-market gains and losses on foreign currency contracts, and certain non-recurring items including start-up costs, settlement loss on pension curtailment and restructuring costs. Adjusted EBITDA is an important metric used by many investors to compare issuers on the basis of the ability to generate cash from operations and management believes that, in addition to net income, Adjusted EBITDA is a useful supplementary measure.

Adjusted EBITDA is a measure not recognized under GAAP and does not have a standardized meaning prescribed by GAAP. Therefore, this measure may not be comparable to similar measures presented by other entities. Investors are cautioned that Adjusted EBITDA should not be construed as an alternative to net income determined in accordance with GAAP as an indicator of Pollard’s performance or to cash flows from operating, investing and financing activities as measures of liquidity and cash flows.

POLLARD BANKNOTE LIMITED

Pollard is one of the leading providers of products and services to lottery and charitable gaming industries throughout the world. Management believes Pollard is the largest provider of instant tickets based in Canada and the second largest producer of instant tickets in the world.

The selected financial and operating information has been derived from, and should be read in conjunction with, the consolidated financial statements of Pollard, as at and for the year ended December 31, 2014. These financial statements have been prepared in accordance with the International Financial Accounting Standards (“IFRS” or “GAAP”).

Results of Operations – Year ended December 31, 2014

Sales

During the year ended December 31, 2014 (“Fiscal 2014” or “2014”), Pollard achieved sales of $194.5 million, compared to $184.9 million in the year ended December 31, 2013 (“Fiscal 2013” or “2013”). Factors impacting the $9.6 million sales increase were:

Higher instant ticket average selling prices for Fiscal 2014 increased sales by $5.4 million compared to Fiscal 2013. This increase was partially a result of increased sales of proprietary products including Scratch FX® and PlayBook® games in 2014. Lower instant ticket sales volumes decreased sales by $5.4 million compared to Fiscal 2013. The majority of this decrease was a result of a significant amount of goods in transit at year-end to international customers. Higher sales of our ancillary instant ticket products and services increased sales by $0.9 million from Fiscal 2013. Charitable gaming volumes were higher than Fiscal 2013 increasing sales by $0.8 million, which was offset by the decrease in average selling price which reduced sales by $0.9 million. A decrease in machine volumes in Fiscal 2014 decreased sales by $0.1 million when compared to 2013.

During Fiscal 2014, Pollard generated approximately 62.3% (2013 – 64.9%) of its revenue in U.S. dollars including a portion of international sales which are priced in U.S. dollars. During Fiscal 2014 the actual U.S. dollar value was converted to Canadian dollars at $1.097 compared to a rate of $1.028 during Fiscal 2013. This 6.7% increase in the U.S. dollar value resulted in an approximate increase of $7.6 million in revenue relative to Fiscal 2013. Also during Fiscal 2014, the Canadian dollar weakened against the Euro resulting in an approximate increase of $1.4 million in revenue relative to Fiscal 2013.

Cost of sales and gross profit

Cost of sales was $153.4 million in Fiscal 2014 compared to $149.7 million in Fiscal 2013. Cost of sales was higher in Fiscal 2014 relative to Fiscal 2013 as a result of higher exchange rates on U.S. dollar transactions in 2014 which increased cost of sales approximately $6.3 million. Also included in cost of sales in Fiscal 2014 was $0.6 million of non-recurring start-up costs related to Pollard’s new iLottery operations. Partially offsetting these increases were reduced costs due to lower volumes, the production mix and recognition of scientific research and experimental development (“SRED”) tax credits.

Gross profit was $41.1 million (21.1% of sales) in Fiscal 2014 compared to $35.2 million (19.0% of sales) in Fiscal 2013. This increase was due mainly to increased average selling price of instant tickets, the higher value of U.S. dollars converted into Canadian dollars and increased sales of ancillary instant ticket products and services. Gross profit excluding non-recurring iLottery start-up costs was $41.7 million (21.4% of sales).

Administration expenses

Administration expenses increased to $17.0 million in Fiscal 2014 from $15.2 million in Fiscal 2013 as a result of increased compensation expenses relating to additional manufacturing support activities including technology, information systems and research and development. The increase in expense was also due to a lower amount of capitalized labour in Fiscal 2014 relating to internal projects.

Selling expenses

Selling expenses were $6.9 million in Fiscal 2014 which was similar to $6.8 million in Fiscal 2013.

Interest expense

Interest expense decreased to $2.9 million in Fiscal 2014 from $3.4 million in Fiscal 2013 primarily as a result of lower interest rates.

Foreign exchange loss

The net foreign exchange loss was $1.9 million in Fiscal 2014 compared to a net loss of $0.1 million in Fiscal 2013. The 2014 net foreign exchange loss consisted of a $1.7 million unrealized loss which was primarily as a result of the increased Canadian equivalent value of U.S. denominated debt and accounts payable due to the weakening of the Canadian dollar relative to the U.S. dollar. The realized foreign exchange loss of $0.2 million was predominately a result of decreased value of foreign currency converted into Canadian dollars during Fiscal 2014.

Within the 2013 net foreign exchange loss were realized foreign exchange gains of $0.9 million comprised of $1.0 million realized gain on the increased value of U.S. dollar denominated receivables and the conversion of U.S. dollars and Euros into Canadian dollars, partially offset by $0.1 million of realized loss relating to payments made on U.S. dollar denominated payables. Offsetting the realized foreign exchange gains were unrealized foreign exchange losses of $1.0 million comprised of an unrealized foreign exchange loss of $0.9 million on U.S. dollar denominated debt and $0.1 million unrealized foreign exchange loss on net U.S. denominated receivables and payables.

Amortization and depreciation

Amortization and depreciation, including depreciation of property and equipment and the amortization of deferred financing costs and intangible assets, totaled $7.9 million during Fiscal 2014 which decreased from $8.6 million during Fiscal 2013 due to decreased amortization of deferred financing costs and license fees.

Adjusted EBITDA

Adjusted EBITDA was $25.6 million in Fiscal 2014 compared to $22.7 million in Fiscal 2013. The primary reasons for the increase in Adjusted EBITDA was the increase in gross profit of $5.9 million. Partially offsetting this increase were the increase in administration expenses of $1.8 million and higher realized foreign exchange losses of $1.1 million.

Income taxes

Income tax expense was $3.7 million in Fiscal 2014, an effective rate of 30.0%, due primarily to differences relating to the foreign exchange impact of Canadian dollar denominated debt in its U.S. subsidiaries. Pollard has capitalized its U.S. operations using intercompany Canadian dollar debt. The weakening of the Canadian dollar versus the U.S. dollar results in a future gain on debt repayment for U.S. tax purposes in the subsidiary, creating a deferred tax expense with no related income (as the gain is eliminated on consolidation). This increased the consolidated provision percentage by about 6%.

Income tax expense was $3.9 million in Fiscal 2013, an effective rate of 41.8%, due primarily to differences relating to the foreign exchange impact of Canadian dollar denominated debt in its U.S. subsidiaries. Pollard has capitalized its U.S. operations using intercompany Canadian dollar debt. The weakening of the Canadian dollar versus the U.S. dollar results in a future gain on debt repayment for U.S. tax purposes in the subsidiary, creating a deferred tax expense with no related income (as the gain is eliminated on consolidation). This increased the consolidated provision percentage by about 9%. Other permanent differences relating to the foreign exchange translation of property, plant and equipment increased the provision by approximately 3%.

Net income

Net income was $8.7 million in Fiscal 2014 compared to net income of $5.4 million in Fiscal 2013. The primary reasons for the increase were the increase in gross profit of $5.9 million, a reduction in interest expense of $0.5 million, a reduction of $0.3 million in the non-cash mark-to-market loss on foreign currency contracts and a decrease in income taxes of $0.2 million. Partially offsetting these increases to net income were the increase in administration expenses of $1.8 million and an increase in foreign exchange loss of $1.8 million.

Earnings per share (basic and diluted) increased to $0.37 per share in Fiscal 2014 from $0.23 per share in Fiscal 2013.

Results of Operations – Three months ended December 31, 2014

During the three months ended December 31, 2014, Pollard achieved sales of $43.2 million, compared to $47.6 million in the three months ended December 31, 2013. Factors impacting the $4.4 million sales decrease were:

Instant ticket sales volumes for the fourth quarter of 2014 were lower than the fourth quarter of 2013 by 13.2%, which combined with a decrease in our ancillary instant ticket products and services volumes, primarily licensed games, reduced sales by $5.8 million. The majority of this decrease was a result of a significant amount of goods in transit at year-end to international customers. In addition, a decrease in average selling price of instant tickets compared to 2013 further decreased sales by $0.5 million. Lower charitable gaming volumes for the quarter decreased sales compared to 2013 by $0.3 million, while an increase in the average selling price increased sales by $0.2 million when compared to the fourth quarter of 2013.

During the three months ended December 31, 2014, Pollard generated approximately 60.8% (2013 – 59.8%) of its revenue in U.S. dollars including a portion of international sales which were priced in U.S. dollars. During the fourth quarter of 2014 the actual U.S. dollar value was converted to Canadian dollars at $1.137, compared to the rate of $1.047 during the fourth quarter of 2013. This 8.6% increase in the value of the U.S. dollar resulted in an approximate increase of $2.0 million in revenue relative to 2013.

Cost of sales was $33.4 million in the fourth quarter of 2014 compared to $38.4 million in the fourth quarter of 2013. Cost of sales was lower in the quarter relative to the fourth quarter of 2013 primarily as a result of decreased sales volumes and the recognition of SRED tax credits. Partially offsetting the decrease, higher exchange rates on U.S. dollar transactions in the fourth quarter of 2014 increased cost of sales approximately $1.6 million when compared to the fourth quarter of 2013.

Gross profit was $9.8 million (22.7% of sales) in the fourth quarter of 2014 compared to $9.2 million (19.3% of sales) in the fourth quarter of 2013. This increase in gross profit dollars was due mainly to the higher value of U.S. dollars converted into Canadian dollars and the recognition of SRED tax credits, partially offset by the gross profit reduction on lower sales volumes.

Administration expenses were $4.6 million in the fourth quarter of 2014 which was higher compared to $4.2 million in the fourth quarter of 2013 due in part to higher costs related to business development initiatives.

Selling expense was $1.7 million in the fourth quarter of 2014 which was similar to $1.7 million in the fourth quarter of 2013.

Interest expense decreased to $0.6 million in the fourth quarter of 2014 from $0.8 million in the fourth quarter of 2013 primarily as a result of lower interest rates.

The net foreign exchange loss was $0.8 million in the fourth quarter of 2014 compared to a net loss of $0.3 million in the fourth quarter of 2013. The 2014 net foreign exchange loss consisted of an unrealized foreign exchange loss of $0.9 million which was mostly as a result of the increased Canadian equivalent value of U.S. denominated payables and long-term debt caused by the weakening of the Canadian dollar relative to the U.S. dollar at the end of the quarter. The additional realized foreign exchange gain of $0.1 million, was predominately a result of the increased value of U.S. denominated receivables, offset partially by increased cost of U.S. denominated payables.

Within the 2013 fourth quarter net foreign exchange loss was an unrealized foreign exchange loss of $0.5 million consisting of $0.4 million relating to unrealized foreign exchange loss on U.S. dollar denominated debt and $0.1 million relating to the unrealized foreign exchange loss on net U.S. dollar denominated receivables and payables. Partially offsetting the unrealized foreign exchange loss was a $0.2 million realized foreign exchange gain on the increased value of U.S. and Euro denominated receivables.

Amortization and depreciation, including depreciation of property, plant and equipment and the amortization of deferred financing costs and intangible assets, totaled $2.0 million during the fourth quarter of 2014 which decreased from $2.7 million during the fourth quarter of 2013 as a result of decreased amortization of development costs and license fees in 2014.

Adjusted EBITDA was $5.6 million in the fourth quarter of 2014 compared to $6.3 million in the fourth quarter of 2013. The primary reasons for the decrease in Adjusted EBITDA were the decrease in gross profit (net of amortization and depreciation) of $0.1 million and higher administration expenses of $0.4 million.

Income tax expense was nil in the fourth quarter of 2014, an effective rate of 0.0%. Included in the effective rate are differences relating to the foreign exchange impact of Canadian dollar denominated debt in its U.S. subsidiaries. Pollard has capitalized its U.S. operations using intercompany Canadian dollar debt. The significant weakening of the Canadian dollar versus the U.S. dollar in the fourth quarter results in a future gain on debt repayment for U.S. tax purposes in the subsidiary, creating a deferred tax expense with no related income (as the gain is eliminated on consolidation). This increased the consolidated provision percentage by about 16%. Other permanent differences relating to the foreign exchange translation of property, plant and equipment decreased the provision by approximately 15%. In addition, adjustments in the annual estimated tax rate to the actual tax rate in the U.S. subsidiaries decreased the provision by approximately 28%.

Income tax expense was $1.0 million in the fourth quarter of 2013, an effective rate of 52.6%, due primarily to differences relating to the foreign exchange impact of Canadian dollar denominated debt in its U.S. subsidiaries. Pollard has capitalized its U.S. operations using intercompany Canadian dollar debt. The significant weakening of the Canadian dollar versus the U.S. dollar in the fourth quarter results in a future gain on debt repayment for U.S. tax purposes in the subsidiary, creating a deferred tax expense with no related income (as the gain is eliminated on consolidation). This increased the consolidated provision percentage by about 16%. Other increases were due to permanent differences relating to the translation of the company’s U.S. subsidiaries.

Net income was $2.1 million in the fourth quarter of 2014 compared to $0.9 million in the fourth quarter of 2013. The primary reasons for the increase were the increase in gross profit of $0.6 million, the $1.0 million decrease in the non-cash mark-to-market loss on foreign currency contracts, a decrease in income tax expense of $0.4 million and the $0.2 million decrease in interest expense. Partially offsetting these increases in net income were the increase in administration expenses of $0.4 million and the $0.5 million increase in net foreign exchange loss.

Earnings per share (basic and diluted) increased to $0.09 per share in the fourth quarter of 2014 from $0.04 per share in the fourth quarter of 2013.

Outlook

The outlook for both our industry and Pollard for 2015 is very positive. The lottery industry continues to generate robust growth, particularly in the instant ticket product line. Consumer demand for instant tickets remains strong and this trend is anticipated to continue. Government jurisdictions continue to look for ways to generate increased funds for their good causes and instant tickets continue to be a key mechanism to accomplish this goal. Recent industry data has shown retail sales growth of instant tickets in the 6-8% range in 2014.

Our current contract portfolio is strong and will support our anticipated level of business as we benefit from a full year of volumes from our new contracts won during 2014. We have no major contracts coming due in 2015 when extensions are considered and we will strategically tender for other lottery contracts that come up for bid.

We anticipate our production volumes remaining at similar levels to that of 2014 in the first half of the year prior to our new press coming on stream. We will work diligently to build our volume once the press line is fully operational. Contracts usually run on a 3-5 year cycle so the buildup of additional volumes will follow a disciplined and strategic approach.

Our average selling prices have trended positively over the last two years and we expect this to continue. Strong sales of our value added proprietary products are forecasted to continue as lotteries have recognized the additional return on investment to be earned when utilizing our key products such as Scratch FX® or our unique PlayBook® offerings. The success of these products underlines the importance of innovation in our industry and we will focus on ongoing research and development initiatives including using a structured development process to maximize our innovation success. Products such as our exclusive PlayAround™ Fold-Over ticket and our environmentally friendly Eco ScratchTM instant ticket are just two examples of recent products currently gaining traction in the marketplace.

The Michigan Lottery iLottery site will continue to evolve from start-up to a more mature operation and we are hopeful the initial success experienced in 2014 will continue going forward. We expect the iLottery market in the United States will grow as more lotteries make the decision to develop this distribution method and we will look to replicate our success in Michigan to other jurisdictions.

Licensed games sales vary based on the timing and availability of certain licensed properties and 2015 revenue for this product line is anticipated to be slightly lower than the last two years of record levels. We are actively sourcing new licensed properties that will resonate in the lottery space and will be vigorously promoting our current best sellers such as Frogger and Tetris®.

As our lottery customers expand the breadth and sophistication of their product offerings, we have renewed our focus on utilizing strategic alliances with outside organizations to expand and grow our own expertise, including more actively pursuing acquisition opportunities to bring additional value added capability to Pollard.

The weakening of the Canadian dollar has provided additional positive impacts on our net operating cash flow during 2014 and this ongoing trend will have a positive effect on future net cash flows. A weaker Canadian dollar also allows us to be more competitive in bidding for new work which will be important as our new capacity comes on stream later in 2015.

Our new press expansion project continues to track on time with a commissioning planned for the second quarter of 2015. The new press line will add significant new capacity to our production capability and additionally will provide improved efficiencies and lower per unit costs on our existing volumes.

We will continue on our ERP system development during the next year and anticipate the initial roll out to begin during the second quarter of 2015, with a number of modules being implemented over the last half of 2015. Implementation of our ERP system and related management processes will provide a foundation to maximize returns on both our existing operations and the new press expansion.

Budgeted capital expenditures for 2015 are expected to be lower than the levels of expenditures incurred in 2014, although still higher than historical levels due to the completion of the press expansion and ERP projects.

We anticipate our internal operating cash flow over the next year generating sufficient funds to satisfy all of our requirements including the capital expenditures required to complete our new press line expansion and the implementation of our ERP system initiative. Our current credit facility provides flexibility and capacity to support our various strategic initiatives and any additional excess cash inflow will be used to reduce our senior bank debt.