WINNIPEG, Manitoba, May 5, 2015 /CNW/ — Pollard Banknote Limited (TSX: PBL) (“Pollard”) released its financial

results for the three months ended March 31, 2015, with increased revenue and higher EBITDA compared to the first quarter last year.

“Our first quarter results continues the positive trend displayed in 2014, with strong achievement in all of our key metrics,” commented Co-Chief Executive Officer John Pollard. “Good volumes, stable pricing and effective cost management, in conjunction with the weaker Canadian dollar, have all factored into quarterly EBITDA levels only exceeded once in the past 6 years.”

“Our new press is expected to be commissioned late in the second quarter and, as we bring the press fully up to speed over the last half of 2015, we anticipate an improving cost platform and additional available capacity to grow our volumes.”

“Particularly strong during the first quarter was our free cash flow, driven by higher operating results and effective management of our working capital, which enabled us to fund significant capital expenditures relating to our press expansion without significantly increasing our debt.”

“The lottery industry continues its positive momentum, with ongoing strength in the instant ticket market providing opportunity for Pollard to continue to grow,” said Co-Chief Executive Officer Doug Pollard. “Continuing traction of our specialty products has allowed us to maintain strong value added pricing.”

“The rollout of our Michigan iLottery operation has established a new benchmark for iLottery start-ups and we are actively pursuing other opportunities within the lottery industry.”

“We are very pleased with the results achieved in the first quarter of 2015 and remain extremely positive about the opportunities in front of us,” concluded John Pollard. “We continue to work with lotteries throughout the world to develop new revenue sources, increase the returns of existing instant ticket product lines and maximize the funds they generate for their various good causes.”

POLLARD BANKNOTE LIMITED

Pollard is one of the leading providers of products and services to lottery and charitable gaming industries throughout the world. Management believes Pollard is the largest provider of instant tickets based in Canada and the second largest producer of instant tickets in the world.

Use of Non-GAAP Financial Measures

Reference to “Adjusted EBITDA” is to earnings before interest, income taxes, depreciation and amortization, unrealized foreign exchange gains and losses, mark-to-market gains and losses on foreign currency contracts, and certain non-recurring items including startup costs. Adjusted EBITDA is an important metric used by many investors to compare issuers on the basis of the ability to generate cash from operations and management believes that, in addition to net income, Adjusted EBITDA is a useful supplementary measure.

Adjusted EBITDA is a measure not recognized under GAAP and does not have a standardized meaning prescribed by GAAP. Therefore, this measure may not be comparable to similar measures presented by other entities. Investors are cautioned that Adjusted EBITDA should not be construed as an alternative to net income determined in accordance with GAAP as an indicator of Pollard’s performance or to cash flows from operating, investing and financing activities as measures of liquidity and cash flows.

The selected financial and operating information has been derived from, and should be read in conjunction with, the condensed consolidated unaudited interim financial statements of Pollard, for the three months ended March 31, 2015. These financial statements have been prepared in accordance with the International Financial Accounting Standards (“IFRS”or “GAAP”).

Results of Operations – Three months ended March 31, 2015

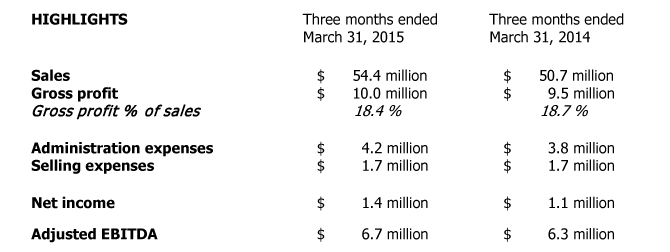

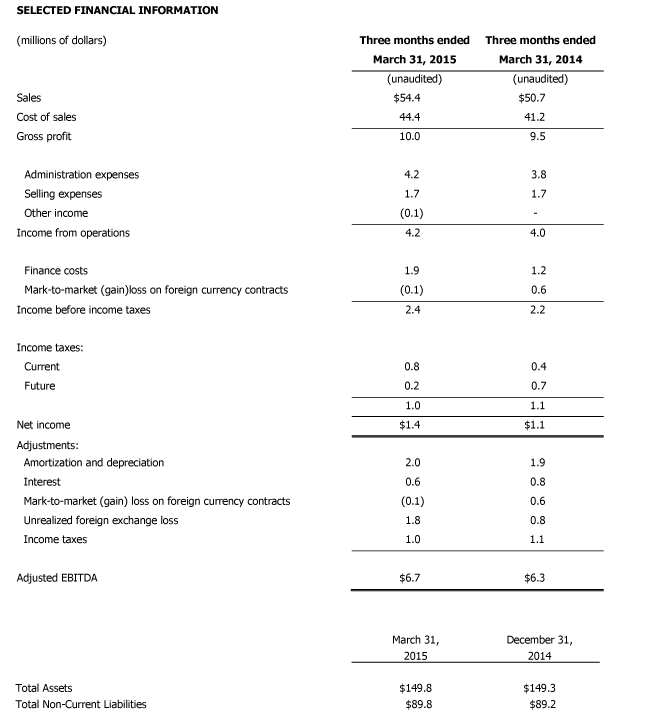

During the three months ended March 31, 2015, Pollard achieved sales of $54.4 million, compared to $50.7 million in the three months ended March 31, 2014. A number of factors resulted in the $3.7 million sales increase.

Cost of sales was $44.4 million in the first quarter of 2015 compared to $41.2 million in the first quarter of 2014. Cost of sales was higher by $0.5 million as a result of increased instant ticket volumes. Higher exchange rates on U.S. dollar transactions in the first quarter of 2015 increased cost of sales approximately $2.7 million when compared to the first quarter of 2014.

Gross profit earned in the first quarter of 2015 was $10.0 million (18.4% of sales) as compared to $9.5 million (18.7% of sales) earned in the first quarter of 2014. This increase was due mainly to the increase in instant ticket volumes, as well as the weakening of the Canadian dollar relative to the U.S. dollar.

Administration expenses increased to $4.2 million in the first quarter of 2015 from $3.8 million in the first quarter of 2014 due primarily to increased compensation costs.

Selling expenses were $1.7 million in the first quarter of 2015 which was similar to $1.7 million in the first quarter of 2014.

Interest expense decreased to $0.6 million in the first quarter of 2015 from $0.8 million in the first quarter of 2014 primarily as a result of lower interest rates.

The net foreign exchange loss was $1.2 million in the first quarter of 2015 compared to a loss of $0.4 million in the first quarter of 2014. Within the 2015 net foreign exchange loss was an unrealized foreign exchange loss of $1.8 million predominately a result of unrealized loss on U.S. dollar denominated debt (caused by the weakening of the value of the Canadian dollar versus the U.S. dollar) in addition to an unrealized loss on other U.S. dollar denominated accounts payable. Partially offsetting the unrealized loss was a realized gain of $0.6 million primarily relating to the increased value of U.S. dollar denominated accounts receivable.

Within the 2014 net foreign exchange loss was an unrealized foreign exchange loss of $0.8 million comprised of a $0.6 million unrealized loss on U.S. dollar denominated debt (caused by the weakening of the value of the Canadian dollar versus the U.S. dollar) in addition to an unrealized loss of $0.2 million on other U.S. dollar denominated assets. Partially offsetting the unrealized loss was a realized gain of $0.4 million primarily relating to the increased value of U.S. dollar denominated accounts receivable.

Adjusted EBITDA was $6.7 million in the first quarter of 2015 compared to $6.3 million in the first quarter of 2014. The primary reason for the increase in Adjusted EBITDA was the increased gross profit and realized foreign exchange gains, partially offset by increased administration expenses.

Income tax expense was $1.0 million in the first quarter of 2015, an effective rate of 41.4%, higher than our expected effective rate of 26.7% due primarily to differences relating to the foreign exchange impact of Canadian dollar denominated debt in its U.S. subsidiaries. Pollard has capitalized its U.S. operations using intercompany Canadian dollar debt. The weakening of the Canadian dollar versus the U.S. dollar results in a future gain on debt repayment for U.S. tax purposes in the subsidiary, creating a deferred tax expense with no related income (as the gain is eliminated on consolidation). This increased the effective tax rate by about 34 percentage points. Other differences relating to changes in the expected income tax rate, including permanent difference relating to the foreign exchange translation of property, plant and equipment, decreased the effective tax rate by approximately 19 percentage points on a net basis.

Income tax expense was $1.1 million in the first quarter of 2014, an effective rate of 50.1%, higher than our expected effective rate of 26.7% due primarily to differences relating to the foreign exchange impact of Canadian dollar denominated debt in its U.S. subsidiaries. Pollard has capitalized its U.S. operations using intercompany Canadian dollar debt. The weakening of the Canadian dollar versus the U.S. dollar results in a future gain on debt repayment for U.S. tax purposes in the subsidiary, creating a deferred tax expense with no related income (as the gain is eliminated on consolidation). This increased the effective tax rate by about 16 percentage points. Other differences relating to changes in the expected income tax rate increased the effective tax rate by approximately 8 percentage points.

Amortization and depreciation, including amortization of deferred financing costs and intangible assets and depreciation of property and equipment, totaled $2.0 million during the first quarter of 2015 which was similar to $1.9 million during the first quarter of 2014.

Net income increased to $1.4 million in the first quarter of 2015 from $1.1 million in the first quarter of 2014. The primary reasons were the $0.5 million increase in gross profit and the $0.7 million increase in the non-cash mark-to-market gain on foreign currency contracts. These increases were partially offset by the increase in the foreign exchange loss of $0.8 million.

Net income per share (basic and diluted) increased to $0.06 per share in the first quarter of 2015 from $0.05 per share in the first quarter of 2014.

Outlook

Lottery industry sales data continues to show strong demand for instant tickets with consumers in jurisdictions throughout the world. The variety of different options and products marketed at retail has grown significantly and has been a key factor in the growth of the instant ticket market. Indications are there is continuing consumer interest in instant tickets and we expect these trends to continue.

We anticipate our volumes to continue at similar levels to the last few quarters leading up to the start-up of our new press. Once our new capacity comes fully on stream we will have the availability of added capacity to strategically bid for additional volumes. There have been no material changes to our current contract portfolio and we have no material contracts up for rebid in 2015 when considering renewals.

Commissioning of the new press expansion project is planned for late in the second quarter of 2015. The lottery industry does feature a relatively long selling cycle due to the long term nature of the contracts. As a result the new press line’s additional capacity will take some period of time to become fully utilized and will have more of an impact on our volumes going forward in 2016 and beyond.

The Michigan iLottery operation continues to exceed early expectations and we will continue to build customer counts and revenue as the advertising and customer acquisition processes are implemented. While still small in absolute dollar amounts, the impact of this operation is positive to our bottom line and will grow going forward. The North American lottery industry itself is taking a cautious approach to iLottery expansion, however we believe over time more jurisdictions will take advantage of this new source of revenue.

The Canadian dollar weakened significantly against the U.S. dollar during the first quarter of 2015. As previously noted we sell a majority of our revenue denominated in U.S. dollars and, after our natural internal hedges relating to U.S. dollar purchases, our net exposure remains U.S. dollar cash positive. The movement of the Canadian dollar had a positive impact on our cash flow in the first quarter of 2015, which will continue if the Canadian dollar remains weak.

Anticipated capital expenditures for the remainder of 2015 are expected to be lower than the levels of expenditures incurred in 2014 and the first quarter of 2015, as the press expansion moves into the completion stage.

We anticipate our internal operating cash flow over the next year will generate sufficient funds to satisfy all of our requirements including the remaining capital expenditures required to complete our new press line expansion. Our current credit facility provides flexibility and capacity to support our various strategic initiatives and any additional excess cash inflow will be used to reduce our senior bank debt.

“Our first quarter results continues the positive trend displayed in 2014, with strong achievement in all of our key metrics,” commented Co-Chief Executive Officer John Pollard. “Good volumes, stable pricing and effective cost management, in conjunction with the weaker Canadian dollar, have all factored into quarterly EBITDA levels only exceeded once in the past 6 years.”

“Our new press is expected to be commissioned late in the second quarter and, as we bring the press fully up to speed over the last half of 2015, we anticipate an improving cost platform and additional available capacity to grow our volumes.”

“Particularly strong during the first quarter was our free cash flow, driven by higher operating results and effective management of our working capital, which enabled us to fund significant capital expenditures relating to our press expansion without significantly increasing our debt.”

“The lottery industry continues its positive momentum, with ongoing strength in the instant ticket market providing opportunity for Pollard to continue to grow,” said Co-Chief Executive Officer Doug Pollard. “Continuing traction of our specialty products has allowed us to maintain strong value added pricing.”

“The rollout of our Michigan iLottery operation has established a new benchmark for iLottery start-ups and we are actively pursuing other opportunities within the lottery industry.”

“We are very pleased with the results achieved in the first quarter of 2015 and remain extremely positive about the opportunities in front of us,” concluded John Pollard. “We continue to work with lotteries throughout the world to develop new revenue sources, increase the returns of existing instant ticket product lines and maximize the funds they generate for their various good causes.”

POLLARD BANKNOTE LIMITED

Pollard is one of the leading providers of products and services to lottery and charitable gaming industries throughout the world. Management believes Pollard is the largest provider of instant tickets based in Canada and the second largest producer of instant tickets in the world.

Use of Non-GAAP Financial Measures

Reference to “Adjusted EBITDA” is to earnings before interest, income taxes, depreciation and amortization, unrealized foreign exchange gains and losses, mark-to-market gains and losses on foreign currency contracts, and certain non-recurring items including startup costs. Adjusted EBITDA is an important metric used by many investors to compare issuers on the basis of the ability to generate cash from operations and management believes that, in addition to net income, Adjusted EBITDA is a useful supplementary measure.

Adjusted EBITDA is a measure not recognized under GAAP and does not have a standardized meaning prescribed by GAAP. Therefore, this measure may not be comparable to similar measures presented by other entities. Investors are cautioned that Adjusted EBITDA should not be construed as an alternative to net income determined in accordance with GAAP as an indicator of Pollard’s performance or to cash flows from operating, investing and financing activities as measures of liquidity and cash flows.

The selected financial and operating information has been derived from, and should be read in conjunction with, the condensed consolidated unaudited interim financial statements of Pollard, for the three months ended March 31, 2015. These financial statements have been prepared in accordance with the International Financial Accounting Standards (“IFRS”or “GAAP”).

Results of Operations – Three months ended March 31, 2015

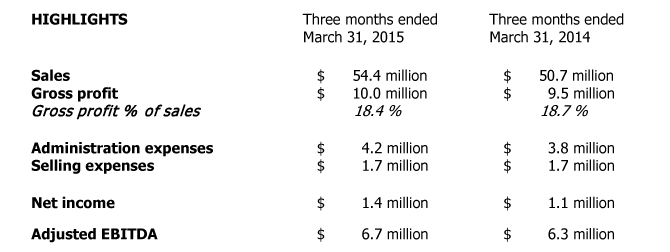

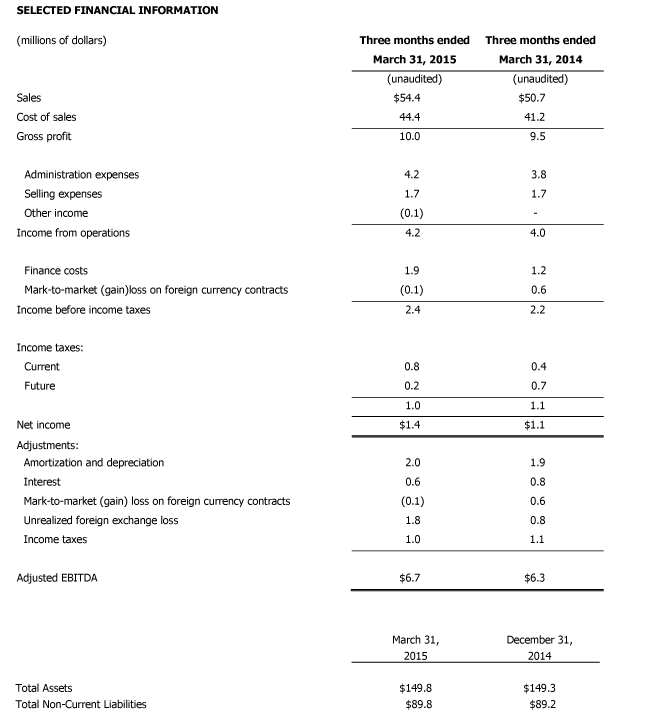

During the three months ended March 31, 2015, Pollard achieved sales of $54.4 million, compared to $50.7 million in the three months ended March 31, 2014. A number of factors resulted in the $3.7 million sales increase.

- Instant ticket volumes for the first quarter of 2015 were higher than the first quarter of 2014 by 9.8% which increased sales by $4.0 million. Offsetting this increase was a decrease in sales of ancillary instant ticket products and services of $3.2 million due primarily to a large non-recurring licensed game sale in 2014. In addition, a slight decrease in average selling price compared to 2014 further decreased sales by $0.4 million. Charitable gaming volumes declined for the quarter which reduced sales by $0.4 million, which was partially offset by an increase in average selling price which increased sales by $0.1 million. A decrease in machine volumes further decreased sales by $0.1 million when compared to the first quarter of 2014.

- During the three months ended March 31, 2015, Pollard generated approximately 67.9% (2014 – 70.1%) of its revenue in U.S. dollars including a portion of international sales which are priced in U.S. dollars. During the first quarter of 2015 the actual U.S. dollar value was converted to Canadian dollars at $1.214, compared to a rate of $1.093 during the first quarter of 2014. This 11.1% increase in the U.S. dollar value resulted in an approximate increase of $3.7 million in revenue relative to the first quarter of 2014. Also during the quarter, the value of the Canadian dollar strengthened against the Euro resulting in an approximate decrease of $0.2 million in revenue relative to the first quarter of 2014.

Cost of sales was $44.4 million in the first quarter of 2015 compared to $41.2 million in the first quarter of 2014. Cost of sales was higher by $0.5 million as a result of increased instant ticket volumes. Higher exchange rates on U.S. dollar transactions in the first quarter of 2015 increased cost of sales approximately $2.7 million when compared to the first quarter of 2014.

Gross profit earned in the first quarter of 2015 was $10.0 million (18.4% of sales) as compared to $9.5 million (18.7% of sales) earned in the first quarter of 2014. This increase was due mainly to the increase in instant ticket volumes, as well as the weakening of the Canadian dollar relative to the U.S. dollar.

Administration expenses increased to $4.2 million in the first quarter of 2015 from $3.8 million in the first quarter of 2014 due primarily to increased compensation costs.

Selling expenses were $1.7 million in the first quarter of 2015 which was similar to $1.7 million in the first quarter of 2014.

Interest expense decreased to $0.6 million in the first quarter of 2015 from $0.8 million in the first quarter of 2014 primarily as a result of lower interest rates.

The net foreign exchange loss was $1.2 million in the first quarter of 2015 compared to a loss of $0.4 million in the first quarter of 2014. Within the 2015 net foreign exchange loss was an unrealized foreign exchange loss of $1.8 million predominately a result of unrealized loss on U.S. dollar denominated debt (caused by the weakening of the value of the Canadian dollar versus the U.S. dollar) in addition to an unrealized loss on other U.S. dollar denominated accounts payable. Partially offsetting the unrealized loss was a realized gain of $0.6 million primarily relating to the increased value of U.S. dollar denominated accounts receivable.

Within the 2014 net foreign exchange loss was an unrealized foreign exchange loss of $0.8 million comprised of a $0.6 million unrealized loss on U.S. dollar denominated debt (caused by the weakening of the value of the Canadian dollar versus the U.S. dollar) in addition to an unrealized loss of $0.2 million on other U.S. dollar denominated assets. Partially offsetting the unrealized loss was a realized gain of $0.4 million primarily relating to the increased value of U.S. dollar denominated accounts receivable.

Adjusted EBITDA was $6.7 million in the first quarter of 2015 compared to $6.3 million in the first quarter of 2014. The primary reason for the increase in Adjusted EBITDA was the increased gross profit and realized foreign exchange gains, partially offset by increased administration expenses.

Income tax expense was $1.0 million in the first quarter of 2015, an effective rate of 41.4%, higher than our expected effective rate of 26.7% due primarily to differences relating to the foreign exchange impact of Canadian dollar denominated debt in its U.S. subsidiaries. Pollard has capitalized its U.S. operations using intercompany Canadian dollar debt. The weakening of the Canadian dollar versus the U.S. dollar results in a future gain on debt repayment for U.S. tax purposes in the subsidiary, creating a deferred tax expense with no related income (as the gain is eliminated on consolidation). This increased the effective tax rate by about 34 percentage points. Other differences relating to changes in the expected income tax rate, including permanent difference relating to the foreign exchange translation of property, plant and equipment, decreased the effective tax rate by approximately 19 percentage points on a net basis.

Income tax expense was $1.1 million in the first quarter of 2014, an effective rate of 50.1%, higher than our expected effective rate of 26.7% due primarily to differences relating to the foreign exchange impact of Canadian dollar denominated debt in its U.S. subsidiaries. Pollard has capitalized its U.S. operations using intercompany Canadian dollar debt. The weakening of the Canadian dollar versus the U.S. dollar results in a future gain on debt repayment for U.S. tax purposes in the subsidiary, creating a deferred tax expense with no related income (as the gain is eliminated on consolidation). This increased the effective tax rate by about 16 percentage points. Other differences relating to changes in the expected income tax rate increased the effective tax rate by approximately 8 percentage points.

Amortization and depreciation, including amortization of deferred financing costs and intangible assets and depreciation of property and equipment, totaled $2.0 million during the first quarter of 2015 which was similar to $1.9 million during the first quarter of 2014.

Net income increased to $1.4 million in the first quarter of 2015 from $1.1 million in the first quarter of 2014. The primary reasons were the $0.5 million increase in gross profit and the $0.7 million increase in the non-cash mark-to-market gain on foreign currency contracts. These increases were partially offset by the increase in the foreign exchange loss of $0.8 million.

Net income per share (basic and diluted) increased to $0.06 per share in the first quarter of 2015 from $0.05 per share in the first quarter of 2014.

Outlook

Lottery industry sales data continues to show strong demand for instant tickets with consumers in jurisdictions throughout the world. The variety of different options and products marketed at retail has grown significantly and has been a key factor in the growth of the instant ticket market. Indications are there is continuing consumer interest in instant tickets and we expect these trends to continue.

We anticipate our volumes to continue at similar levels to the last few quarters leading up to the start-up of our new press. Once our new capacity comes fully on stream we will have the availability of added capacity to strategically bid for additional volumes. There have been no material changes to our current contract portfolio and we have no material contracts up for rebid in 2015 when considering renewals.

Commissioning of the new press expansion project is planned for late in the second quarter of 2015. The lottery industry does feature a relatively long selling cycle due to the long term nature of the contracts. As a result the new press line’s additional capacity will take some period of time to become fully utilized and will have more of an impact on our volumes going forward in 2016 and beyond.

The Michigan iLottery operation continues to exceed early expectations and we will continue to build customer counts and revenue as the advertising and customer acquisition processes are implemented. While still small in absolute dollar amounts, the impact of this operation is positive to our bottom line and will grow going forward. The North American lottery industry itself is taking a cautious approach to iLottery expansion, however we believe over time more jurisdictions will take advantage of this new source of revenue.

The Canadian dollar weakened significantly against the U.S. dollar during the first quarter of 2015. As previously noted we sell a majority of our revenue denominated in U.S. dollars and, after our natural internal hedges relating to U.S. dollar purchases, our net exposure remains U.S. dollar cash positive. The movement of the Canadian dollar had a positive impact on our cash flow in the first quarter of 2015, which will continue if the Canadian dollar remains weak.

Anticipated capital expenditures for the remainder of 2015 are expected to be lower than the levels of expenditures incurred in 2014 and the first quarter of 2015, as the press expansion moves into the completion stage.

We anticipate our internal operating cash flow over the next year will generate sufficient funds to satisfy all of our requirements including the remaining capital expenditures required to complete our new press line expansion. Our current credit facility provides flexibility and capacity to support our various strategic initiatives and any additional excess cash inflow will be used to reduce our senior bank debt.